Spotify Stock Bounces Back from Its Post-Earnings Plunge, But Is SPOT Stock a Buy Right Now?

/Spotify%20logo%20by%20Bastian%20Riccardi%20via%20Unsplash.jpg)

Spotify Technology (SPOT) shares declined by more than 11% on July 29, marking the company’s worst performance in a single day since July 2023. The decline was preceded by a disappointing Q2 earnings report that fell short of Wall Street forecasts on the top and bottom lines, and was coupled with subdued guidance for the next quarter. The news left many investors surprised, as the platform’s growth continues in the area of audiobooks and AI-driven music discovery tools.

However, the broader technology industry remains healthy. Big names like Meta (META), Microsoft (MSFT), and eBay (EBAY) have reported robust earnings, demonstrating ongoing demand for online content.

Today, meanwhile, SPOT stock is on the rebound, up 6% intraday after announcing plans to hike prices in select global markets starting in September. Plus, Phillips Capital upgraded Spotify to “Neutral” from “Reduce” in the wake of its post-earnings retreat. Is now the time to consider adding Spotify shares? Here's a closer look.

About Spotify Stock

Spotify Technology (SPOT) is the world’s leading audio streaming company based in Stockholm, Sweden. It covers music, podcasting, as well as audiobooks, with paid subscription and advertisement-driven streaming as sources of earned revenues. The market capitalization of Spotify is $128.38 billion.

SPOT shares have surged 100.7% in the past 52-week span, handily outgaining the S&P 500 Index’s ($SPX) ~18% gain in that same period. The shares have, however, retraced by about 15% off their June highs at $785.

Even following the pullback, one of the primary points of contention for the stock is its valuation. SPOT is valued at roughly 98 times forward adjusted earnings with a 6.46 price-sales ratio, much higher than most of its peers. Even if those multiples may be a vote of confidence on Spotify’s long-term growth and scale narrative, they don’t do much to alleviate fears of whether the company is already priced for perfection after the year of frenzied run-up.

Spotify is a growth stock that pays no dividend currently. The company’s strategy remains on reinvestment for future development and not capital return.

Spotify Falls Short on Earnings

Spotify generated Q2 2025 revenues of €4.19 billion, below the estimated €4.26 billion. More concerning was the unexpected net loss of €86 million, or €0.42 per share, versus the estimated €1.90 in earnings on the Street. The poor showing was driven by higher personnel and marketing expenses, as well as €115 million of so-called “social charges,” which are payroll taxes on equity compensation tied to the recent rally in its shares.

Management predicted Q3 2025 revenue of €4.2 billion, far short of consensus views of €4.47 billion. The firm noted a 490-basis-point forex headwind and macro volatility as key reasons behind the conservative guide.

However, user growth remains healthy. Monthly users grew 11% year-over-year to 696 million, while paying subscribers grew 12% to 276 million. Spotify is guiding for 710 million users and 281 million paying subscribers by the end of Q3.

There was more interaction with brand-new functionality in the quarter, like its AI-powered DJ - whose use more than doubled year-over-year - as well as playing of audiobooks, where usage surged 35% across America, Great Britain, and Australia. CEO Daniel Ek did criticize execution failures, but believes in the long-term plan: “While I’m unhappy with where we are today, I remain confident in the ambitions we laid out for this business, and we’re working quickly to ensure we’re on the right path.”

Spotify also revealed a $1 billion extension of the share buyback program, demonstrating optimism in the stock’s intrinsic value despite near-term volatility in earnings.

What Do Analysts Expect for Spotify Stock?

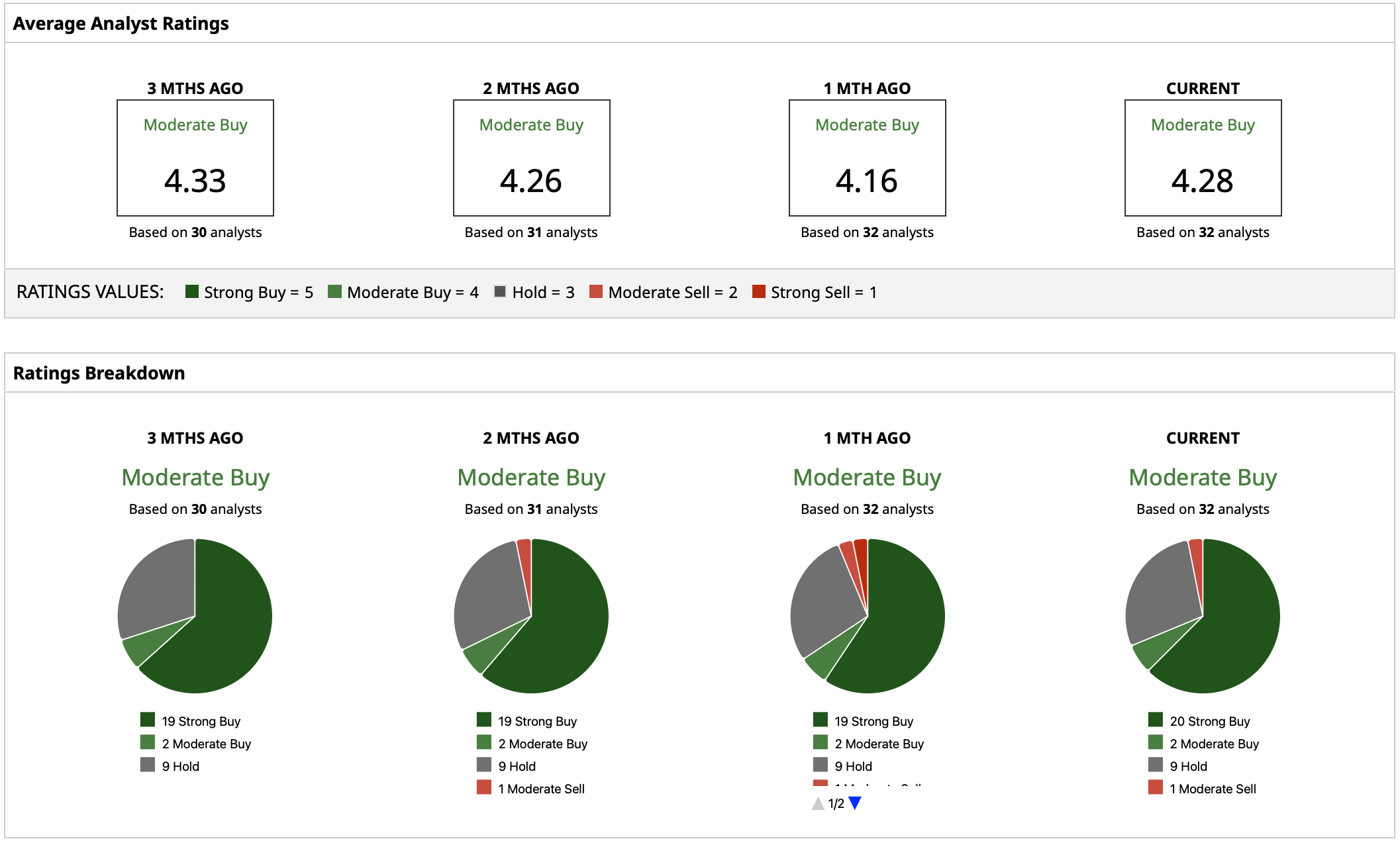

Currently, 32 analysts cover SPOT stock, and rate it with a “Moderate Buy” consensus. Spotify's mean price target is $738.12, indicating 10.7% expected additional upside from current levels. The top price target on the Street is $900, and the most negative estimate foresees the risk of declining as far as $484 - a reflection of the volatility and valuation sensitivity of the company.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.